In India’s digital banking system, NEFT (National Electronic Funds Transfer) and RTGS (Real Time Gross Settlement) are two major electronic payment methods regulated by the Reserve Bank of India (RBI). Both systems enable secure bank-to-bank fund transfers, but they differ in terms of settlement speed, transaction value, and usage purpose.

Understanding the difference between NEFT and RTGS helps individuals and businesses choose the most suitable mode of money transfer.

What is NEFT?

NEFT (National Electronic Funds Transfer) is an electronic payment system in which funds are transferred in batches at fixed intervals. Transactions are not settled individually but are accumulated and processed together. NEFT is commonly used for small to medium-value transactions such as salary payments, bill payments, and personal fund transfers. There is no minimum transaction limit, making it accessible to all users.

What is RTGS?

RTGS (Real Time Gross Settlement) is a fund transfer system where transactions are settled in real time and on a gross basis. Each transaction is processed individually and instantly. RTGS is mainly used for high-value and time-sensitive transactions. It requires a minimum transfer amount of ₹2 lakh, and once processed, the transaction is final and irreversible.

Difference Between NEFT and RTGS

NEFT (National Electronic Funds Transfer) transfers money in batches and is suitable for small to medium-value transactions, while RTGS (Real Time Gross Settlement) transfers funds instantly on a gross basis, mainly for high-value and urgent payments. The Difference Between NEFT and RTGS has been tabulated below in detail.

| Parameter | NEFT (National Electronic Funds Transfer) | RTGS (Real Time Gross Settlement) |

|---|---|---|

| Full Form | National Electronic Funds Transfer | Real Time Gross Settlement |

| Settlement Type | Deferred net settlement; transactions are settled in batches | Real-time gross settlement; transactions are settled individually as they occur |

| Processing Speed | Transfers are processed in hourly or half-hourly batches, may take a few hours depending on the bank | Transfers are instant, processed in real time |

| Transaction Value | Suitable for small and medium-value transactions | Suitable for high-value transactions |

| Minimum Transaction Limit | No minimum limit | ₹2 lakh (minimum) |

| Maximum Transaction Limit | No upper limit (subject to bank policy) | No upper limit (subject to bank policy) |

| Availability | 24×7 online NEFT available; some banks have branch timings for offline | 24×7 online RTGS available; some banks have branch timings for offline |

| Charges / Fees | RBI has waived charges for online NEFT transactions; banks may charge for offline | RBI has waived charges for online RTGS transactions; banks may charge for offline |

| Reversibility | Can be reversed or returned in case of errors before settlement | Transactions are final and irrevocable once processed |

| Ideal Usage | Salaries, utility bills, tuition fees, rent payments, personal transfers | High-value corporate transactions, property payments, urgent fund transfers |

| Settlement Risk | Low, as transactions are settled in batches with netting | Very low, as settlement is immediate and gross |

| Time Sensitivity | Not suitable for urgent high-value transfers | Suitable for urgent, high-value transfers |

| Bank Branch Dependency | Can be initiated online or via bank branches | Can be initiated online or via bank branches |

| Regulating Authority | Reserve Bank of India (RBI) | Reserve Bank of India (RBI) |

| Examples of Use | Paying school fees, sending money to relatives, paying utility bills | Buying property, transferring funds between corporate accounts, urgent business payments |

Conclusion

NEFT and RTGS play a crucial role in strengthening India’s digital payment infrastructure. While NEFT offers flexibility and convenience for everyday transactions, RTGS ensures instant settlement for high-value payments. Knowing the difference between NEFT and RTGS enables users to make informed banking decisions and is also important from an exam perspective.

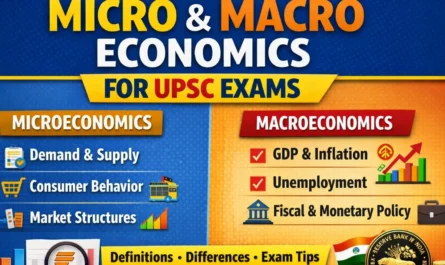

UPSC Prelims PYQ

Consider the following statements in respect of RTGS and NEFT: [2025]

I. In RTGS, the settlement time is instantaneous, while in case of NEFT, it takes some time to settle payments.

II. In RTGS, the customer is charged for inward transactions while that is not the case for NEFT.

III. Operating hours for RTGS are restricted on certain days while this is not true for NEFT.

Which of the statements above are correct?

(a) I only

(b) I and II

(c) I and III

(d) III only

Correct Answer: (a) I only